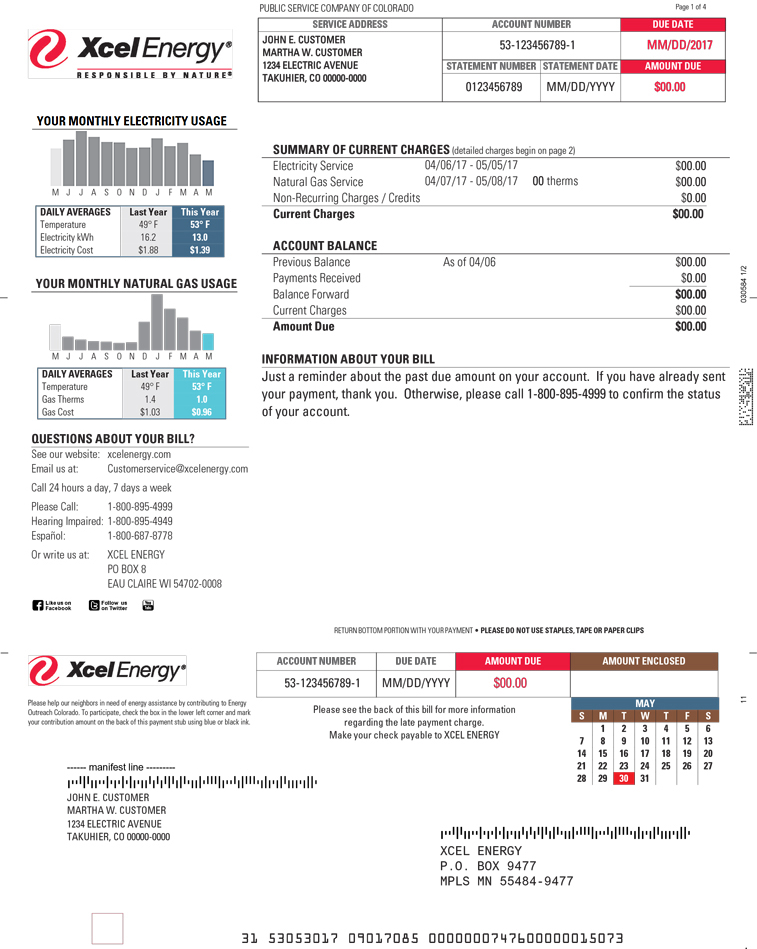

What is actually a no Records (Zero Doctor) Financial?

A no documentation (zero doctor) home loan is a loan to get property that will not want money verification on the borrower. Such financing, now practically illegal, is as an alternative recognized toward a declaration one to confirms the latest debtor normally afford the loan repayments.

Zero doc mortgages have been commonly made available to those whoever incomes aren’t easily confirmed, so they really was greater risk borrowers. Mainly unregulated, these fund were situated with the selling possible of your shielded possessions and installment design of your own home loan. Find out more about how zero doctor mortgage loans performs and regarding the financing requirements now.

Secret Takeaways

- Zero papers mortgages not one of them money verification about borrower, only an affirmation your borrower can be pay back the loan.

- No doctor mortgage loans are commonly offered to prospects that simply don’t possess a typical income source and additionally those people who are notice-operating.

- Just like the Great Credit crunch, real no doctor mortgages is actually basically illegal.

- “No doctor” mortgages may now become fund that don’t want antique income-verifying data files, but you to still require almost every other files.

- Zero doc mortgages generally require high down costs and better attract cost than conventional mortgage loans.

Exactly how No Documentation (No Doc) Mortgages Works

A no documentation home loan is that loan to order a home that does not need the income documents necessary for an everyday home loan. This type of financing are thought higher risk.

Usually, you must fill in proof money so you’re able to be eligible for a home loan. Requisite documentation vary from W2s, pay stubs, a career letters, and/otherwise present taxation statements. Lenders want to see as possible pay for money toward mortgage, so that they want research you really have a reliable and you can legitimate source of income.

Particular mortgages, but not, don’t require any proof of earnings. Talking about entitled zero paperwork (no doctor) mortgage loans, no paperwork fund, if any money confirmation mortgage loans. With the loans, borrowers are not required to render plenty of papers, for instance the docs in the list above. Alternatively, they might just need to render an affirmation one to implies they are able to pay off the borrowed funds. Such mortgage loans are generally supplied to the people that simply don’t have a normal source of income, self-working anyone, brand new immigrants, otherwise temporary professionals.

Earnings requirements are merely area of the standards you really need to feel acknowledged getting a mortgage. You’ll also must fulfill almost every other requirements instance a straight down commission and you will good credit, among others.

Zero files (zero doctor) mortgages dont meet with the Consumer credit Coverage Operate demands in order to fairly make sure the fresh new borrower’s financials. Because they don’t require money verification, this type of mortgage loans is extremely high-risk. In addition they include even more uncommon since the 2010 passing of Dodd-Frank Wall Street Change and User Coverage Work, which needs papers for the all sorts of funds-especially mortgages.

Passed on the aftermath of financial crisis from 2008, the fresh new Dodd-Honest Wall surface Roadway Reform and you may User Cover Act instituted reforms and change towards the banking/economic world, many of which concerned about the credit company. Subprime mortgage loans or any other highest-chance loan products-notorious due to their large degrees of standard-was in fact sensed one of the head culprits of crisis, which caused the two-12 months High Market meltdown.

No Doc Mortgage loans Since the loan places Warrior 2010

In a way, genuine no doctor mortgages no more are present. Today, zero lender commonly depend simply on your own phrase that one can pay off the loan, because they did throughout the homes s. That it practice are unlawful. Loan providers need to be sure all the details you promote with a couple version of files.

not, mortgage lenders can always convenience their needs off money papers inside other ways. Individuals can invariably pick finance that don’t wanted tax statements and other traditional earnings-verifying data files. Rather, the financial institution gives you have fun with other things, particularly financial statements otherwise broker comments, to show to satisfy the mortgage repayments.