On this page

- Advance payment

- Deposit Commission

- Mediocre Down-payment

- Serious Currency

Generally, the newest down payment matter to the a house pick should be from the the very least 20%, even though some recent alterations in financing enjoys triggered lower conditions. It’s always a smart idea to enjoys a talk to their mortgage lender to choose simply how much you’ll need to set out. Generally, a required advance payment count possess varied anywhere between 10% and you will 20%, however with the loan software, needed deposit number is altering.

Advance payment

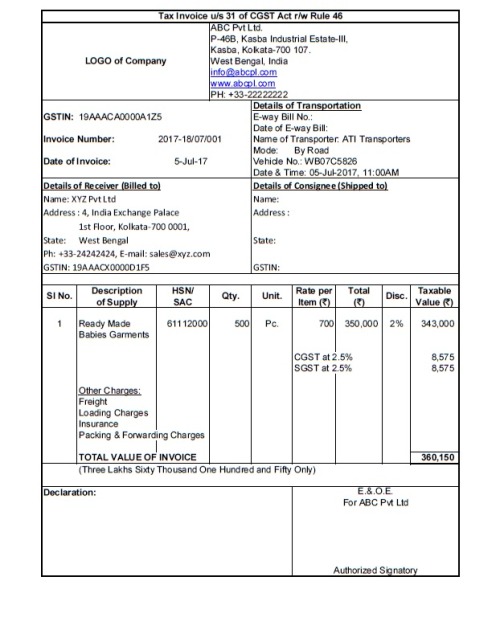

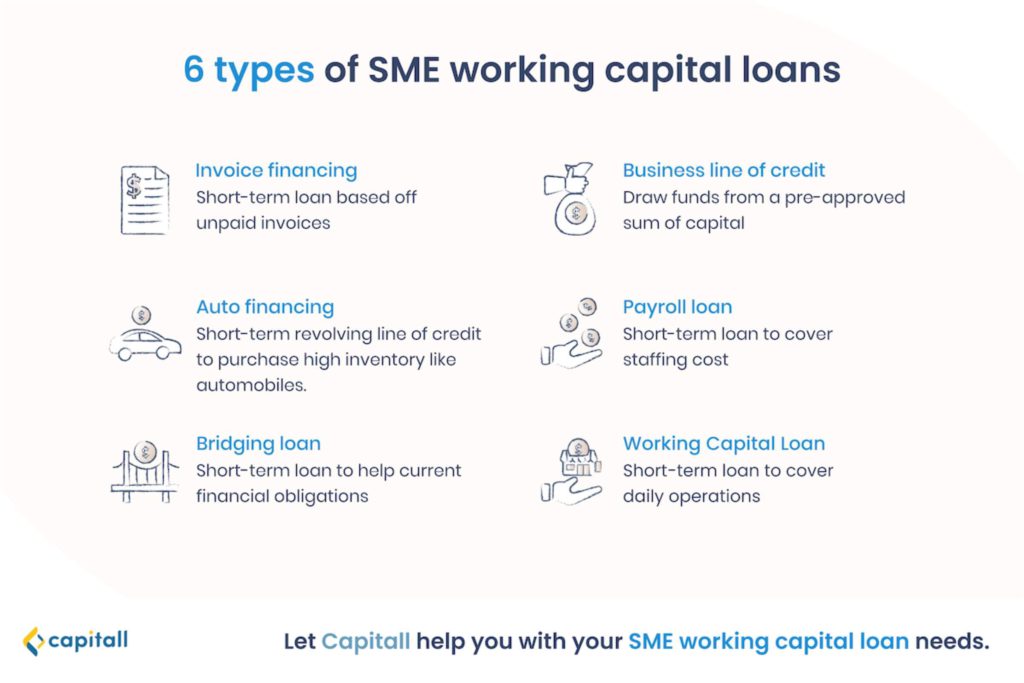

The down-payment amount necessary for a great $650K house hinges on the lender’s standards as well as your personal circumstances. Some individuals features zero down-payment conditions, while some can pay as low as step 3% or 5% of conversion price. Putting on the practical 20% helps you stop purchasing financial insurance coverage and attention and may also save you thousands of dollars. To expect to pay ranging from $19,five hundred and you may $130,000 because a deposit for the a great $650,000 pick. Remember, as well as the advance payment matter, you will also have so you can reason for settlement costs.

Nearly all loan providers need a down payment. Financial institutions generally speaking have fun with good Vantage rating while you are Credit ratings are used by the other loan providers. Whenever you are not knowing and therefore method a certain lender spends, you might contact new lending institution and have how much of a deposit they expect.

To determine your ideal down payment you need to basic dictate the finances. The best way to calculate how much cash you really can afford for every single day, feedback their bank card and you may lender statements. Centered on your own conclusions you’ll have best regarding just how much house you can afford, this will leave you a range of your own potential down-payment number. It is very important provides at least down payment commission, regardless of the sort of mortgage you’ll receive.

Using a closing prices calculator is the best cure for determine everything what you should need certainly to give the fresh dining table into the closing date.

New down payment percentage to own an effective $650K house varies, and that’s influenced by your own personal finances and you will financial bundle. Some people are able to set absolutely nothing off, and others will need to put down no less than step three%. However, of several lenders choose you place at the very least 20% down, that will help save you several thousand dollars in the home loan insurance policies and you may attract. The fresh new payment you establish will be based to the brand of mortgage your qualify for. The following is a fast table with different down payment rates to own an excellent $650,000 financial.

The home To shop for Institute advises putting off 20% or higher. Yet not, extent you really can afford relies on your financial situation and you may where you are. Whilst you might be ready to create a down-payment that you really can afford, you should invariably have a price available to you. A down payment is the most significant debts for the house-to order techniques. And the downpayment, you’ll have to spend settlement costs, particularly lender’s term insurance rates, mortgage issues, and an appraisal otherwise survey commission.

Average Down-payment

If you are searching purchasing a property, you possibly must put down excessively currency on closure. Once the average downpayment to possess a great $650,000 house is 20%, a lot of people lay out below it. New downpayment calculator can help you bundle your coupons and you may funds to get down the minimum you are able to. In addition, new calculator helps you influence what kind of cash your need certainly to rescue monthly.

Saving money having a deposit might be hard for particular, as average lowest deposit on the an excellent $650K house is $19,five hundred or higher, just in case you put on closing costs, that add up to $forty-five,650 or higher. An average month-to-month mortgage payment that have PMI is approximately $step 3,eight hundred. It is essential to understand that the quantity you’ll want to put off depends upon your credit score, your debt-to-earnings proportion, the sort of financial, the https://paydayloancolorado.net/bethune/ pace and also the length of time you will be during the our house.

Serious Money

Earnest money is a means to show a supplier which you is actually intent on to shop for their house. It’s always a price between 1% and you may 3% of the decideded upon cost. Thus having a cost regarding $650,000 expect to get down anywhere between $six,five-hundred and you can $19,500. The brand new decided matter is then listed in an escrow membership till the buy is finalized. Since purchase experience and you can during the closing procedure brand new financing could be create and additionally be applied towards your down percentage. So always grounds so it into the when contemplating how much down payment do you really believe you can afford.