Jumbo financing courtesy BECU are offered as the one another repaired- and you can variable-price money and you will pay for individuals the capability to money land you to definitely much more expensive than just a normal buy.

The fresh Government Houses Fund Institution kits the minimum jumbo loan amount during the $453,one hundred, even if it some high in a few states having ft expensive a residential property will cost you. Buyers seeking highest-well worth services can opt for a great 15- or 29-seasons repaired jumbo mortgage and 5/5, 5/1, step one0/step 1, or 7/1 Fingers.

Because the name implies, that it loan try aimed toward first-time homeowners and you may, from Basic-go out Home Buyer Give System, money would be fixed, old-fashioned otherwise 5/5 Sleeve.

Some other $6,500 may be granted by BECU to greatly help finance an all the way down payment, and you may consumers make the most of lacking to invest origination charges. The style of so it financing helps it be perfect for young consumers incapable of pay for initial down payments, who can work for particularly out of additional agent service.

BECU Va loans

Virtual assistant finance give certified experts, reservists, active-responsibility servicemen and you can people, and you can eligible family members having resource in the way of repaired- or variable-price mortgage loans that have reduced if any down payment choices.

Private mortgage insurance policy is not essential, and you may closing costs and charges are minimal. Experts can apply the Virtual assistant Certification of Eligibility (COE) thanks to an excellent BECU Virtual assistant mortgage, and flexible borrowing degree guidelines allow easier for individuals which have suboptimal credit ratings.

BECU construction finance

Borrowers strengthening belongings by themselves can benefit regarding BECU’s attention-only conditions during the structure phase. As home is finished, financial terms and conditions convert to a long-term home loan without having to document even more files or shell out a lot more fees.

Borrowers who hire elite designers may use BECU’s Rented Creator system, by which mortgages is generally built to be the cause of doing 80% out of loan-to-purchase will cost you, and/or appraised property value the fresh so you’re able to-be-based domestic.

BECU HELOC

House security line of credit (HELOC) finance allow borrowers to gain access to and you will leverage the existing guarantee within the their houses for several financial obligations eg merging financial obligation, while making a serious home improvement, otherwise to shop for almost every other big property. Due to BECU, HELOCs are given no fees having origination, appraisal, term insurance coverage, pre-percentage penalty, escrow, and document mailing.

Tailored just like the an open-avoid financing, home owners normally continue to borrow against the guarantee as they go, rather than taking out an individual contribution upfront. To possess credit commitment players who will be uncertain what the eventual project costs are or who have multiple possessions that require funding, a good HELOC will likely be better.

BECU Home loan Customers Experience

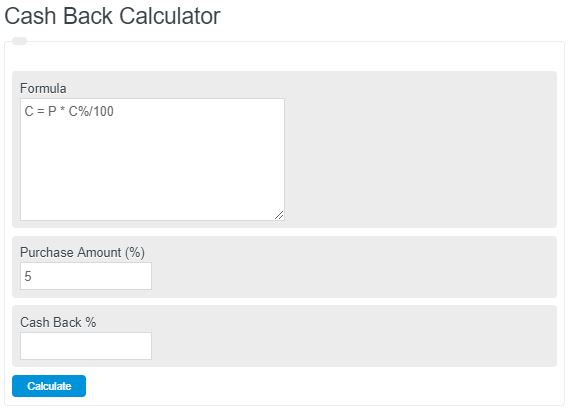

BECU even offers a number of effortless-to-find user resources throughout the the website. As well as home loan calculators, an indigenous Ask a question look club, and you may of good use blog content intent on all of their primary qualities, the brand new monetary institution’s BECU & You webpage is stuffed with entertaining tips eg infographics, webinars, self-moving programs, and you will instructional instructions. Mothers can also use these to interact kids that have financial-literacy resources.

BECU as well as conveniently will bring methods that to get in touch having economic advisors in the a more custom function. Some of those programs ‘s the totally free Financial Health check, that is a single-on-you to definitely, real-day session which have a specialist which facilitate participants take action into budgeting, savings, purchasing, and debt government. Appointments generally last ranging from 40-fifty moments.

personal loans for bad credit in Kingston RI

Free class room demonstrations can also be found to help you West Washington people and you will are led by BECU monetary instructors. Groups are going to be customized to high-school, college or university, or adult audience, with subjects between risk administration and you can credit in order to budgeting and you will first-big date homeownership.

These types of representative-centric qualities complement user friendly meeting-booking provides and easy online programs. Borrowers trying to get lenders on the internet must signal Elizabeth-consent forms and start to become available to the procedure when planning on taking in the 20 minutes or so. A sample record away from circumstances had a need to use on the web become: